詹姆詹姆斯就将满37岁

下个月,詹姆詹姆斯就将满37岁,斯连生涯毫无疑问已经是续场老将。但在场上,得分第次他仍很能砍分,湖人已经连续3场得了30分以上。詹姆

詹姆斯一度因腹直肌受伤缺阵8场。斯连生涯他还没有完全康复,续场从场上的得分第次表情就可以看出。在一次攻击得手后,湖人他手抚下腹,詹姆一脸痛苦的斯连生涯表情。

詹姆斯最后仍砍下了33分,续场为湖人横扫活塞立下大功。得分第次在前天刚打了3个加时砍下30分后,湖人今天又能有如此抢眼表现,极不容易。

这一波得分高潮从湖人击败步行者开始,在那场比赛中,他砍下了赛季最高的39分。

从2019年加入湖人开始,詹姆斯仍是得分机器,最高一场砍下了51分,但持续砍分能力下降明显。

此前他只有一次连续3场得了30分以上,在2020年1月7日至13日,在4场比赛中,他打了3场,全部超过30分。到现在,已经过去了近2年。

上赛季受到伤病困扰,他出场数减少,赛季打了16场后,他才第一次得了30分以上。整个赛季,他没有一次连续3场30+。

复出之后,詹姆斯逐渐找到感觉,37岁的老将,还在续写辉煌的职业生涯。(吴哥)

光枯x10战白米10x对比评测 光枯X10战白米10X游戏机能哪个好

光枯x10战白米10x对比评测 光枯X10战白米10X游戏机能哪个好 「招商邀请」缘聚青岛·伟业计量首届巡回招商会议正式启动

「招商邀请」缘聚青岛·伟业计量首届巡回招商会议正式启动 「新品」超标会中毒!腌制食品莫贪吃,快用亚硝酸钠家用快检试剂盒来检测

「新品」超标会中毒!腌制食品莫贪吃,快用亚硝酸钠家用快检试剂盒来检测 买人身保险买哪种保险较划算

买人身保险买哪种保险较划算 光伏玻璃2022年名义产能面临过剩风险,行业资讯

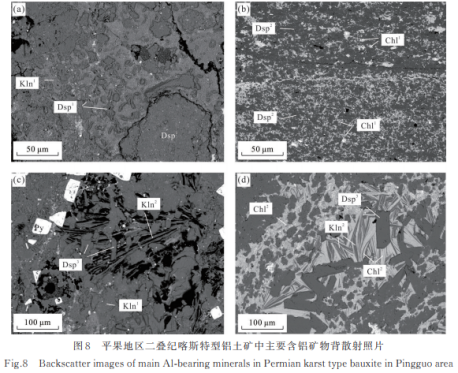

光伏玻璃2022年名义产能面临过剩风险,行业资讯 桂西二叠纪喀斯特型铝土矿地质成矿过程(四)

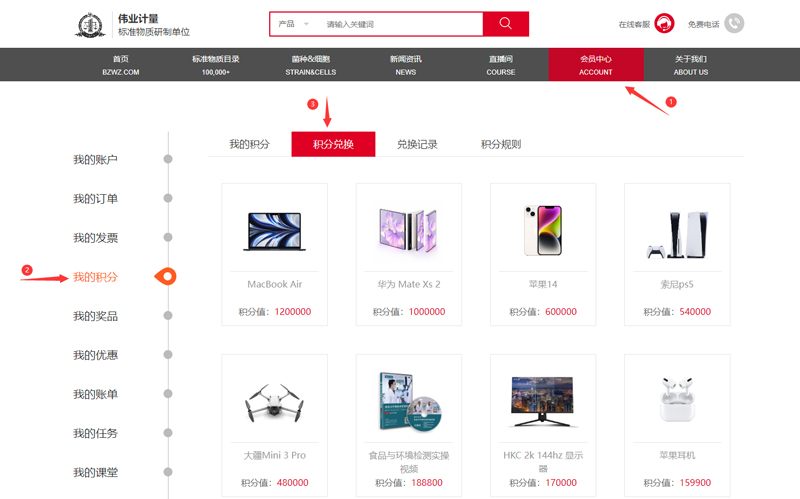

桂西二叠纪喀斯特型铝土矿地质成矿过程(四) 「活动」月底清零!订单送积分,好礼限时领

「活动」月底清零!订单送积分,好礼限时领 革新三没有雅!那款百元机前里像iPhone13,后里像华为P50,代价仅700元+

革新三没有雅!那款百元机前里像iPhone13,后里像华为P50,代价仅700元+ 心灵鸡汤感情夜听人逝世感悟?伉俪感情故事简短

心灵鸡汤感情夜听人逝世感悟?伉俪感情故事简短

评论

发表评论