储存在-18℃以下冰箱中

4、食品操作方法

(1)农药标准液配制

①单一农药标准液:准确称取一定量某农药标准品,中农用丙酮稀释,药残逐一配制成26种农药1000mg/L的测定单一农药标准储备液,储存在-18℃以下冰箱中。食品使用时根据各农药在对应检测器上的中农响应值,吸取适量的药残标准储备液,用丙酮稀释配制成所需的测定标准工作液。

②农药混合标准液将26种农药分为4组,食品按照表8—1中组别,中农根据各农药在对应检测器上的药残响应值,逐一吸取一定体积的测定同组别的单个农药储备液分别注入同一容量瓶中,用丙酮稀释至刻度。食品采用同样方法配制4组农药混合标准储备溶液。中农使用前用丙酮稀释成所需浓度的药残标准工作液。

(2)样品制备:取不少于1000g蔬菜或水果样品,取可食部分用于净纱布轻轻擦去样品表面的附着物。采用对角线分割法,取对角部分,将其切碎,充分混匀放入食品加工器粉碎,制成待测样,放入分装容器中备用。

(3)提取、净化:准确称取25.0g试样放入匀浆机中,加入乙腈50.0mL,高速匀浆2min后用滤纸过滤,滤液收集到装有5~7g氯化钠的100mL具塞量筒中,收集滤液40~50mL。盖上塞子,剧烈振荡1min,在室温下静置10min,使乙腈相和水相分层。

从100mL具塞量筒中,吸取10.00mL乙腈溶液,放入150mL烧杯中,将烧杯放在80℃水浴锅上加入,杯内缓缓通入氮气或空气流,蒸发近干,加入2.0mL丙酮,盖上铝箔待测。

将上述烧杯中用丙酮溶解的样品,完全转移至15mL刻度离心管中,再用约3mL丙酮分3次冲洗烧杯,并转移至离心管,最后准确定容至5.0mL,在旋转混合器上混匀,供色谱测定。如样品过于浑浊,应用0.2μm滤膜过滤后再进行测定。

(4)样品测定

①色谱参考条件

a、色谱柱

预柱:1.0mm,53mm内径,脱活石英毛细管柱。

A柱:50%聚苯基甲基硅氧烷(DB-17或HP-50+)柱,30m×0.53mm×1.0μm。

B柱:100%聚甲基硅氧烷(DB-1或HP-1)柱,30m×0.53mm×1.50μm。

b、温度:进样口温度220℃。检测器温度250℃。程序升温:150℃(保持2min),8℃/min升温至250℃(保持12min)。

②气体及流量:载气:氮气,纯度≥99.999%,流速10mL/min。燃气:氢气,纯度≥99.999%,流速75mL/min。助燃气:空气,流速100mL/min。

③进样方式不分流进样。样品一式两份,由双塔自动进样器同时进样。

④由自动进样器吸取1.0μL标准混合溶液(或净化后的样品)注入色谱仪内,以双柱保留时间定性,以分析柱B获得的样品溶液峰面积与标准溶液峰面积比较定量。

5、结果计算

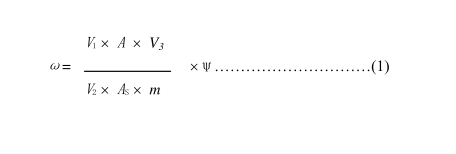

双柱测得的样品中未知组分的保留时间分别与标样在同一色谱上的保留时间相比较,如果样品中某组分的两组保留时间与标准中某一农药的两组保留时间都相差在±0.05min内的可认定为该农药。样品中被测农药残留量以质量分数计,按下式计算:

式中:ω——被测农药残留量,mg/kg;

ψ——标准溶液中农药的含量,mg/L;

A——样品中被测农药的峰面积;

As——农药标准溶液中被测农药的峰面积;

V1——提取溶剂总体积,mL;

V2——吸取出用于检测的提取溶液的体积,mL;

V3——样品定容体积,mL;

m——样品的质量,g。

计算结果保留三位有效数字。

6、说明及注意事项

①本法为NY/T 761.1--2004《蔬菜和水果中有机磷、有机氯、拟除虫菊酯和氨基甲酸类农药多残留检测方法》中的第一部分,适用于水果和蔬菜中26种有机磷类农药多残留检测。

②本方法所用试剂,凡未指明规格者,均为分析纯;水为蒸馏水。

③本方法的检出限在0.0010~0.2500mg/kg。

二、植物性食品中有机氯和拟除虫菊酯类农药多种残留的测定

1、原理

试样中有机氯和拟除虫菊酯农药以有机溶剂提取,经液一液分配及色谱净化除去干扰物质,用电子捕获检测器检测,根据色谱峰的保留时间定性,外标法定量。

2、试剂

试剂除非另有说明,在分析中仅使用确定为分析纯的试剂和蒸馏水(或相当纯度的水)。

①石油醚:沸程60~90℃,重蒸。

②苯重蒸。

③丙酮:重蒸。

④乙酸乙酯:重蒸。

⑤无水硫酸钠。

⑥弗罗里硅土:色谱用,于620℃灼烧4h后备用,用前140℃烘2h,趁热加5%水灭活。

⑦农药标准品:有机氯和拟除虫菊酯农药标准品。

参考资料:食品检测技术,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:农药,标准品,乙腈,离心管

编织法度糊心艺术:Christofle昆庭推出Babylone巴比伦系列

编织法度糊心艺术:Christofle昆庭推出Babylone巴比伦系列 互联网高管的尽头是房地产? | 财讯60秒

互联网高管的尽头是房地产? | 财讯60秒 KD开季连续14场20+分纪录终结!此役仅19分

KD开季连续14场20+分纪录终结!此役仅19分 四人得分20+希罗贡献25分 热火客场轻取独行侠

四人得分20+希罗贡献25分 热火客场轻取独行侠 佛山的文明艺术场馆有哪些

佛山的文明艺术场馆有哪些 强强联手,共赢未来 | 客来福家居和金基地产战略合作签约仪式圆满举行!

强强联手,共赢未来 | 客来福家居和金基地产战略合作签约仪式圆满举行! 王志飞为了小16岁的张歆艺与发妻离婚 却转身娶了小15岁的娇妻

王志飞为了小16岁的张歆艺与发妻离婚 却转身娶了小15岁的娇妻 完成白肉灵芝基因组测序

完成白肉灵芝基因组测序 第一人称感情故事糊心感情网免费感情网站哪个好

第一人称感情故事糊心感情网免费感情网站哪个好 第三轮集中供地也参与了双11“促销”?

第三轮集中供地也参与了双11“促销”? 乡村振兴“听老乡说小康”短视频征稿启事

乡村振兴“听老乡说小康”短视频征稿启事 “双11”观察 :进入新轮回的“双11”有哪些变化?

“双11”观察 :进入新轮回的“双11”有哪些变化? 7000万美元!Vitro在墨西哥玻璃厂投资建造熔炉,国际动态

7000万美元!Vitro在墨西哥玻璃厂投资建造熔炉,国际动态

评论

发表评论